Loading

Get Vat Subsidy Check - Bureau Of Internal Revenue - Ftp Bir Gov

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Vat Subsidy Check - Bureau Of Internal Revenue - Ftp Bir Gov online

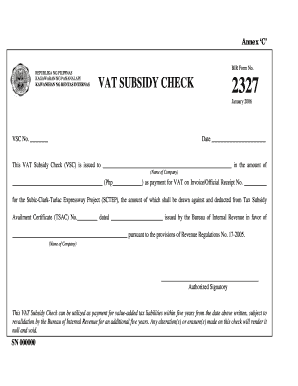

Completing the Vat Subsidy Check is an essential process for businesses seeking to manage their value-added tax liabilities. This guide provides clear instructions on how to accurately fill out the VAT Subsidy Check form to facilitate your tax subsidy claims.

Follow the steps to complete your VAT Subsidy Check form online.

- Click ‘Get Form’ button to access and open the VAT Subsidy Check form.

- In the first field, provide the name of the company receiving the VAT subsidy. Ensure the name matches official records for accuracy.

- Next, enter the amount of the subsidy in Philippine Pesos (Php) in the designated field.

- Fill in the Invoice or Official Receipt number that corresponds to the Subic-Clark-Tarlac Expressway Project (SCTEP) in the appropriate section.

- Provide the Tax Subsidy Availment Certificate (TSAC) number along with the date it was issued. This information is crucial for tracking and validating the subsidy.

- Sign in the ‘Authorized Signatory’ section to confirm the authenticity of the form. Ensure that the signature represents an individual who is authorized to conduct financial matters on behalf of the company.

- Review the completed form for any errors or omissions. It's important to ensure that all entries are correct and clearly legible.

- Once you’ve confirmed the accuracy of all information, you can save changes, download the form, print it, or share it as required for your records.

Complete your VAT Subsidy Check online efficiently to manage your tax obligations effectively.

VAT Refund claim of direct/indirect exporters shall be filed within two (2) years from the close of the taxable quarter when the sales were made. Who may avail: VAT-registered whose sales are zero-rated or effectively zero-rated with excess input taxes (VCAD)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.