Loading

Get Bir Bformb 1947pdf - Ftp Bir Gov

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the BIR BFormb 1947pdf - Ftp Bir Gov online

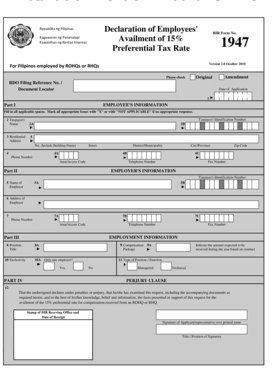

Filling out the BIR BFormb 1947pdf is essential for Filipinos employed by Representative Offices and Regional Headquarters to avail of the 15% preferential tax rate. This guide provides clear instructions on how to complete the form online, ensuring that you meet all necessary requirements.

Follow the steps to fill out the form accurately.

- Click the ‘Get Form’ button to access the form and open it in your editor.

- In Part I, provide the employee's information. Fill in all applicable spaces, marking appropriate boxes with 'X' or selecting 'NOT APPLICABLE' where necessary. Include the taxpayer's name, residential address, and Taxpayer Identification Number.

- Continue filling out your address details, including the building name, street, district or municipality, city or province, zip code, phone number, and fax number, where applicable.

- Part II requires the employer's information. Fill in the employer's name, Taxpayer Identification Number, and address, including phone and fax numbers.

- In Part III, provide your employment information. Include your position title, expected compensation based on your contract, and indicate whether you have only one employer.

- In Part IV, select the type of position or function—mark whether it is managerial or technical.

- Read the perjury clause carefully. Confirm that the information provided is accurate and sign the form. Ensure the title or position of the signatory is also indicated.

- After thoroughly reviewing the form for accuracy, save your changes. You can download, print, or share the completed form as needed.

Take action now and complete your BIR BFormb 1947pdf online!

Related links form

A resident citizen (within and without the Philippines); 2. A resident alien, non-resident citizen or non-resident alien (within the Philippines). This return shall be filed on or before April 15 of each year covering income for the preceding taxable year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.