Loading

Get Form W8imy

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form W8IMY online

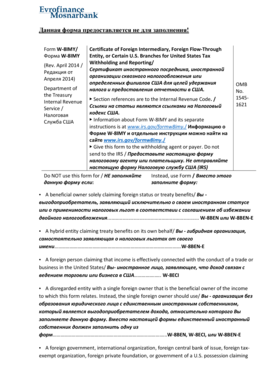

Form W8IMY serves as a certificate of foreign intermediary, foreign flow-through entity, or certain U.S. branches for U.S. tax withholding and reporting purposes. This guide will walk you through the steps required to complete this form online effectively.

Follow the steps to accurately complete the Form W8IMY online.

- Use the ‘Get Form’ button to access and open the Form W8IMY in your preferred online editor.

- In Part I, provide the name of the individual or organization acting as the intermediary. Ensure the country of incorporation or organization is also correctly indicated.

- If applicable, input the name of the disregarded entity, ensuring to specify the Chapter 3 and Chapter 4 status of the entity as required in the relevant sections.

- Accurately fill in the permanent residence address of the intermediary, excluding P.O. boxes.

- Provide additional information like U.S. taxpayer identification number (if applicable) and Global Intermediary Identification Number (GIIN) as needed.

- Complete the relevant certifications in Parts II to XXVIII based on your entity’s compliance status with U.S. tax regulations.

- Once all sections are completed, review the information for accuracy, then save your changes, and choose to download, print, or share the completed form as needed.

Start filling out your Form W8IMY online today to ensure compliance with tax regulations.

The W-8BEN-E – is an application for your company to be exempted from US tax on trading income under the US:UK tax treaty. This is given to your US customer and held by them on file. It is never sent to the IRS unless requested during a compliance visit.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.