Loading

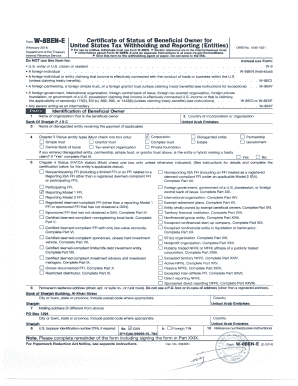

Get Form Wbbene (february 2014) Department Of The Treasury Internal Revenue Service Certificate Of

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form WBBENE (February 2014) Department Of The Treasury Internal Revenue Service Certificate Of online

Filling out the Form WBBENE is essential for entities seeking to establish their status as a beneficial owner for U.S. tax purposes. This guide provides a clear, step-by-step approach to assist users in accurately completing the form online.

Follow the steps to fill out Form WBBENE effectively.

- Click ‘Get Form’ button to obtain the form and open it in your digital editor.

- Begin by entering the name of the organization that is the beneficial owner in the designated field.

- Provide the country of incorporation or organization, ensuring accuracy in the selection.

- If applicable, state the name of any disregarded entity receiving payments.

- Indicate the Chapter 3 status by checking the appropriate box that describes the entity type.

- Select the Chapter 4 status by checking one box that corresponds to the entity's FATCA status. Carefully review the instructions for each classification.

- Complete the permanent residence address with precise details, avoiding P.O. box or in-care-of addresses.

- If applicable, provide a mailing address that differs from the permanent residence address.

- Input the U.S. taxpayer identification number (TIN) if required, or provide the foreign TIN.

- For any disregarded entities or branches receiving payment, ensure you fill out the specific chapter 4 status of those entities.

- Complete the claim of tax treaty benefits if applicable, checking the relevant boxes and providing necessary explanations.

- Finally, review all information for accuracy, then save, download, print, or share the completed form as needed.

Complete your document preparation by filing your Form WBBENE online today.

Form W-8ECI, Certificate of Foreign Person's Claim That Income Is Effectively Connected With the Conduct of a Trade or Business in the United States, is used by a foreign person to: Establish foreign status, Claim that such person is the beneficial owner of the income for which the form is being furnished, and.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.