Loading

Get What Is The Usual Standard Applied To Decide If You Are Loan Worthy

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

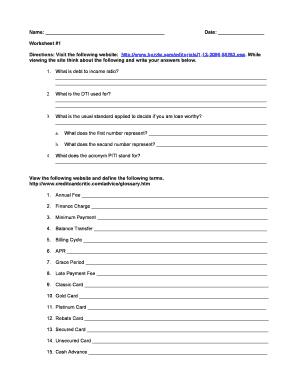

How to use or fill out the What Is The Usual Standard Applied To Decide If You Are Loan Worthy online

Understanding the usual standards for determining loan worthiness is crucial for individuals seeking financial support. This guide provides clear, step-by-step instructions on how to effectively fill out the form related to loan eligibility.

Follow the steps to complete the loan worthiness form successfully.

- Press the ‘Get Form’ button to access the document and open it in your preferred digital platform.

- Begin by entering your name in the designated field at the top of the form.

- Insert the current date in the space provided, ensuring it reflects the date of form completion.

- Navigate to Worksheet #1 and read the directions carefully before proceeding.

- Address the questions concerning debt to income ratio, its purpose, and the usual standards for loan worthiness. Provide detailed answers, ensuring clarity.

- For questions requiring definitions, visit the specified websites to understand the terminology related to finance, such as annual fees and APR. Document your findings clearly.

- Review your responses for accuracy and clarity before proceeding to submit.

- Once completed, you have the option to save your changes, download, print, or share the form accordingly.

Complete your forms online to ensure your loan eligibility determination is accurate and timely.

The five C s of credit—character, capacity, capital, collateral and conditions—offer a solid credit analysis framework that banks can use to make lending decisions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.