Loading

Get Tx Payoff Statement Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Payoff Statement Form online

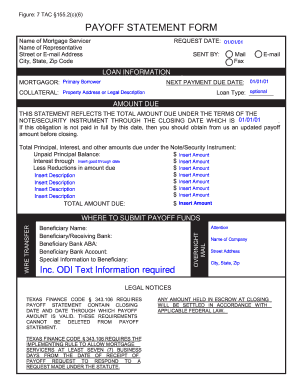

Filling out the TX Payoff Statement Form online is a vital step in managing your mortgage payoff efficiently. This guide will walk you through each section of the form, providing clear and user-friendly instructions tailored to meet your needs.

Follow the steps to complete the TX Payoff Statement Form online.

- Click ‘Get Form’ button to access the TX Payoff Statement Form and open it in your preferred online editing tool.

- Enter the name of the mortgage servicer at the top of the form. This is the organization that manages your loan.

- Below the servicer's name, fill in the representative's name with whom you may be in contact regarding the payoff.

- Provide the street address or email address of the mortgage servicer. Ensure all information is accurate to avoid any delays.

- Complete the city, state, and zip code fields under the contact section to ensure proper delivery.

- Identify the primary borrower by entering their name in the 'Mortgagor' section.

- Insert the request date by specifying the date on which the form is being filled out.

- Select the method by which the statement will be sent, choosing between mail, fax, or email.

- For loan information, ensure correct details about the next payment due date and collateral property address, or legal description are provided.

- Fill in the total amounts due by calculating the unpaid principal balance, interest, and any reductions. Ensure all amounts are inserted accurately.

- Detail the special information for the beneficiary, including their name, receiving bank, ABA number, and bank account information.

- Include any relevant legal notices as required by Texas Finance Code if applicable.

- Finally, review the entire form to verify all entries for accuracy. Once complete, you can save changes, download, print, or share the form as necessary.

Start filling out your TX Payoff Statement Form online today for a smoother mortgage payoff process.

The time it takes to get a mortgage payoff statement can vary by lender, but it typically takes between 3 to 5 business days. If you use a TX Payoff Statement Form, it may expedite the process as you provide all the necessary information upfront. Always check with your lender for specific turnaround times.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.