Get Annual Lease Value Method Employers Worksheet To Calculate

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the annual lease value method employers worksheet to calculate online

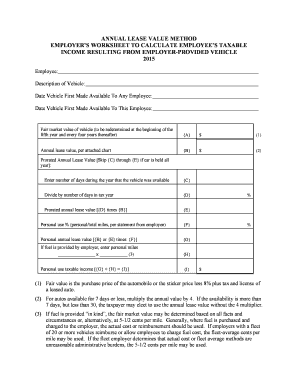

The annual lease value method employers worksheet is essential for determining the taxable income for employees provided with vehicles by their employers. This guide will walk you through the process of filling out this form online, ensuring you understand each component clearly.

Follow the steps to complete the annual lease value worksheet online.

- Click ‘Get Form’ button to obtain the form and open it in your PDF editor.

- Enter the employee's name in the space provided at the top of the form.

- Describe the vehicle being provided, including the make, model, and year.

- Fill in the date the vehicle was first made available to any employee in the designated field.

- Input the date the vehicle was first made available to the specific employee.

- Determine the fair market value of the vehicle and enter this amount in the designated field, ensuring it reflects the correct valuation method as specified.

- Refer to the attached chart to find the corresponding annual lease value based on the fair market value entered. Enter this value in the appropriate space.

- Calculate the prorated annual lease value by entering the number of days the vehicle was available during the year. Divide this by the total number of days in the tax year and record this figure.

- Multiply the prorated annual lease value by the calculated amount from step 7 to get the prorated annual lease value.

- Calculate the personal use percentage by dividing the personal miles by total miles. Input this percentage into the designated field.

- Determine the personal annual lease value by multiplying the annual lease value by the personal use percentage and enter this figure accordingly.

- If applicable, enter personal miles in the space provided and their respective cost for fuel provided by the employer.

- Sum the personal annual lease value and the fuel cost to determine the total personal use taxable income, and document this final amount.

- Review all entries for accuracy, then choose to save changes, download, print, or share the completed form as needed.

Start filling out your annual lease value worksheet online today!

Annual Lease Valuation (ALV) Method If the vehicle was purchased you would use the cost including sales tax, title, and any other purchase expenses. If the vehicle was leased, you can utilize either: Invoice +4% MSRP – 8% Retail value reported by a nationally recognized pricing source if the value is reasonable.

Fill ANNUAL LEASE VALUE METHOD EMPLOYERS WORKSHEET TO CALCULATE

Annual Lease Value Method. Fair market value of vehicle (to be re-determined at the beginning of the fifth year and every four years thereafter). Annual lease value per IRS table. Instructions: This worksheet can be used to calculate the amount to be included in an employee's income due to personal use of an employer-provided automobile. Then read across to column (2) to find the annual lease value. 3. 13. Number of one-way commutes during the year: 25, Lease Table Method.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.