Loading

Get Form Vat-11 Notified Vide Sro 131 Of 2012 Dated 3103

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form VAT-11 Notified Vide SRO 131 Of 2012 Dated 3103 online

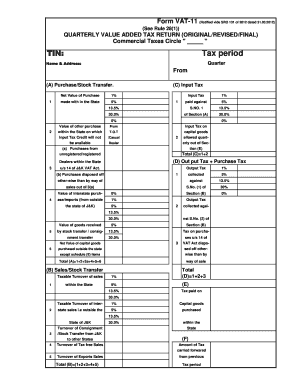

Filling out the Form VAT-11 is essential for tax compliance and reporting under the J&K VAT Act. This guide provides a straightforward, step-by-step approach to completing the form online, ensuring users can navigate each section with ease.

Follow the steps to properly complete the Form VAT-11 online.

- Press the ‘Get Form’ button to obtain the form. This will allow you to open it in the appropriate online format.

- Fill in the Commercial Taxes Circle using the designated area. Enter the tax identification number (TIN) and ensure it is correct.

- Specify the tax period in the relevant field. Include the beginning and end dates of the quarter you are reporting.

- Provide your name and address in the next section. Accuracy is crucial to ensure correspondence can be directed appropriately.

- In section (A), list the net value of purchases made within the state. This includes input tax and any purchases relating to capital goods.

- Complete sections (B) and (C) regarding taxable turnover and sales by entering the relevant figures. Include sales for both stock transfers and other transactions.

- Assess deductions in section (G) and input tax available in section (H). Clearly outline any retained or reversed input tax.

- Calculate the total tax payable or excess input tax in section (I) and determine if any security payments were made.

- Review the additional fields in sections (K) and other outstanding dues. Ensure all aspects related to tax credits and refunds are addressed.

- Finally, save your changes, download a copy, print the form, or share it as required. Make sure to keep a copy for your records.

Complete your VAT forms online today to ensure compliance and streamline your tax reporting process.

Value-added tax (VAT) is a consumption tax on goods and services that is levied at each stage of the supply chain where value is added, from initial production to the point of sale.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.