Loading

Get Payroll Deduction Authorization - Decision Hr

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PAYROLL DEDUCTION AUTHORIZATION - Decision Hr online

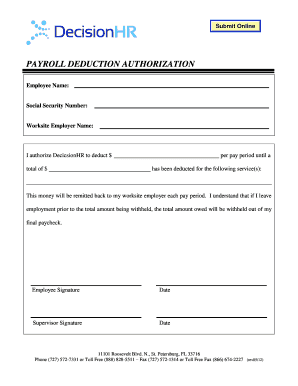

Filling out the Payroll Deduction Authorization form is a crucial step for managing payroll deductions with Decision Hr. This guide will walk you through each section of the form, ensuring that your completion is clear and efficient.

Follow the steps to complete your Payroll Deduction Authorization form online.

- Press the ‘Get Form’ button to access the Payroll Deduction Authorization form and open it in your document management tool.

- In the first field labeled 'Employee Name', enter your full name as it appears on your employment records.

- Next, locate the 'Social Security Number' field. Provide your nine-digit Social Security Number accurately to ensure proper identification.

- In the 'Worksite Employer Name' section, fill in the name of the organization you are employed with to clarify the association with your deductions.

- Proceed to the authorization amount. In the space provided, enter the specific amount you authorize to be deducted from each pay period.

- Follow with the total amount that you wish to deduct over the course of your employment. This amount should be clearly indicated.

- Specify the service or services for which these deductions are being made by filling in the designated area.

- Understand that the money will be remitted to your worksite employer with each pay period. Review any necessary terms regarding employment termination and deductions from your final paycheck.

- After filling out all sections, sign where it states 'Employee Signature', and include the date of signing.

- If required, the supervisor must also provide their signature and date to complete the authorization process.

- Once you have filled out all sections, save your changes to the document. You may then download, print, or share the completed form as needed.

Complete your Payroll Deduction Authorization form online now to streamline your payroll management.

At DecisionHR, we simplify payroll and tax management, ensuring compliance with federal and state regulations while handling all tax payments and filings. Learn More.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.