Loading

Get Va Loan Comparison - Msofcoinfo

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA Loan Comparison - Msofcoinfo online

This guide provides comprehensive instructions on how to accurately fill out the VA Loan Comparison - Msofcoinfo form online. By following the step-by-step guidance, users will be able to complete the form efficiently and understand its various components.

Follow the steps to fill out the VA Loan Comparison form effectively.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

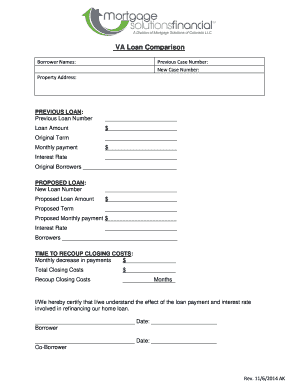

- Fill in the 'Borrower Names' section with the names of all individuals applying for the loan. Ensure accuracy as this information will be critical throughout the loan process.

- Enter the 'Previous Case Number' and 'New Case Number' in their respective fields. This helps in tracking your loan history and the proposed loan application.

- Complete the 'Property Address' field, being as detailed as necessary to clearly identify the property associated with the loan.

- In the 'Previous Loan' section, provide the 'Previous Loan Number', 'Loan Amount', 'Original Term', 'Monthly Payment', and 'Interest Rate'. Each entry must be precise to reflect the exact details of the prior loan.

- Proceed to the 'Proposed Loan' section and fill in the 'New Loan Number', 'Proposed Loan Amount', 'Proposed Term', and 'Proposed Monthly Payment'. These details should reflect what you intend for your new loan.

- Complete the 'Interest Rate' field for the proposed loan to specify your expectations regarding interest costs.

- Enter the 'Time to Recoup Closing Costs' by indicating the 'Monthly Decrease in Payments', the 'Total Closing Costs', and the number of 'Months' required to recoup these costs. This information is crucial for understanding the financial benefits of refinancing.

- Finally, review the certification statement. Each borrower must sign and date the form in the designated areas to confirm understanding of the loan payment and interest rate implications.

- After completing all sections, save your changes. You may also download, print, or share the completed form as needed.

Complete the VA Loan Comparison form online today for a smooth loan application process.

ON THIS PAGE LenderRateAPRBank of the West 30 year fixed Points: 06.500% 30 year fixed6.509%Bank of America 30 year fixed Points: 0.7436.250% 30 year fixed6.337%Schools First FCU 30 year fixed Points: 06.125% 30 year fixed6.136%First Citizens Bank 30 year fixed Points: 06.000% 30 year fixed6.009%8 more rows

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.