Loading

Get Canada Fin 146 2016-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada FIN 146 online

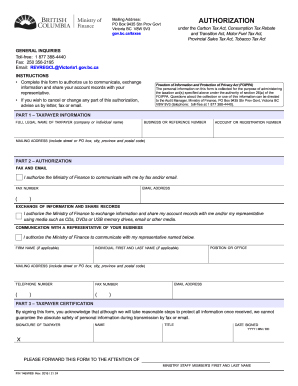

The Canada FIN 146 form is crucial for authorizing communication with the Ministry of Finance regarding your taxation matters. This guide provides clear and supportive instructions to help you complete the form accurately and efficiently.

Follow the steps to complete your Canada FIN 146 online.

- Press the ‘Get Form’ button to access the FIN 146 form and open it in the editor.

- In Part 1, provide your full legal name, business or reference number, and account registration number. Make sure to include the complete mailing address, including the street address or PO box, city, province, and postal code.

- In Part 2, check the boxes to authorize the Ministry of Finance to communicate with you via fax and/or email. Enter your email address and fax number as applicable.

- Authorize the exchange of information and sharing of records by checking the corresponding box. Specify your representative's firm name, if applicable, followed by their first and last name, position or office, mailing address, telephone number, fax number, and email address.

- In Part 3, sign the form to confirm your authorization. Include your name, title, and the date signed in the format YYYY/MM/DD.

- Once the form is completed, save your changes. You can then download, print, or share your finished Canada FIN 146 form as needed.

Complete your Canada FIN 146 form online today to ensure your information is properly authorized.

To get a Tax Identification Number (TIN) in Canada, you need to apply through the Canada Revenue Agency. Generally, this process includes providing your personal information and relevant documentation. Canada FIN 146 can assist you with step-by-step guidance on obtaining your TIN easily.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.