Loading

Get Form 13449 Rev 3-2011 Agreement To Assessment And Collection Of Penalties Under 31 Usc 5321a5 And

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 13449 Rev 3-2011 Agreement to Assessment and Collection of Penalties Under 31 USC 5321(a)(5) online

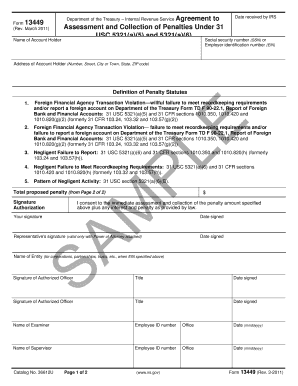

The Form 13449 Rev 3-2011 is essential for individuals and entities who wish to agree to the assessment and collection of penalties related to foreign financial agency transaction violations. This guide will provide step-by-step instructions for completing this form effectively online.

Follow the steps to fill out Form 13449 Rev 3-2011 accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the name of the account holder in the designated field. Ensure that the name matches the official records to avoid any issues.

- Provide the social security number (SSN) or employer identification number (EIN) of the account holder. This identification is crucial for processing the agreement.

- Fill in the complete address of the account holder, including the street number, city or town, state, and ZIP code. Accurate information ensures proper communication from the IRS.

- Review the definitions of the penalty statutes listed in the form. Select the applicable boxes corresponding to the violations you are consenting to, ensuring you are aware of the penalties involved.

- Indicate the total proposed penalty amount. This should be the sum of any penalties calculated for the violations selected.

- Sign and date the form in the designated signature fields to formally consent to the assessment and collection of the specified penalty.

- If applicable, provide the signature and date of any representative authorized to act on behalf of the entity, along with the name and title of the authorized officer.

- Complete the sections required for IRS processing, including the name and identification numbers of the examiner and supervisor, as applicable.

- Once all fields are completed and reviewed for accuracy, save changes, download a copy for your records, and print or share the form as needed.

Complete your Form 13449 online to ensure timely and accurate processing of your agreement.

The Secretary of the Treasury may impose a civil money penalty of not more than $500 on any financial institution or nonfinancial trade or business which negligently violates any provision of this subchapter (except section 5336) or any regulation prescribed under this subchapter (except section 5336).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.