Get Bofa Hardship Letter

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the BoFA Hardship Letter online

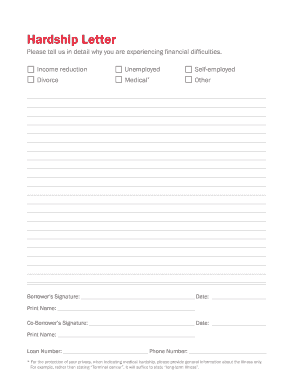

The BoFA Hardship Letter is an essential document for those facing financial difficulties, allowing users to communicate their situation effectively. This guide provides clear instructions on how to complete the form online to ensure a smooth submission process.

Follow the steps to complete the BoFA Hardship Letter.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the section asking for your reasons for experiencing financial difficulties, provide detailed information. You may select options such as income reduction, unemployment, self-employment, divorce, medical issues, or other reasons. Be sure to describe your situation thoroughly.

- For any medical hardships you indicate, remember to provide only general information about your illness to ensure your privacy is protected. For example, instead of mentioning a specific condition, you can state 'long-term illness'.

- In the signature area, the primary borrower should provide their signature and the date. Then, print their name clearly. If applicable, the co-borrower should also sign and date the document, followed by printing their name.

- Complete the loan number and phone number fields accurately to ensure your document is processed without delays.

- After filling in all necessary information, review the document for completeness and accuracy. Make any necessary edits.

- Finally, you can save your changes, download the completed form, print it for your records, or share it as needed.

Complete your BoFA Hardship Letter online today to take the first step towards addressing your financial challenges.

Yes, you can negotiate your debt with Bank of America. If you are facing a significant financial hardship, a BoFA Hardship Letter can be a valuable tool in this process. Presenting your hardship letter allows Bank of America to see your situation clearly, which may help them provide options like payment plans or debt settlements. Being proactive is key to finding a reasonable solution.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.