Get Ny First B Notice

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY First B Notice online

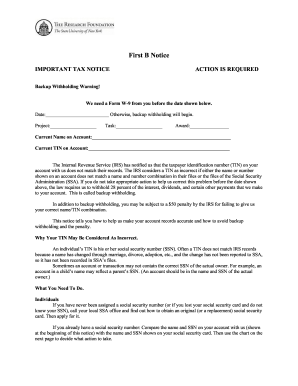

The NY First B Notice is an important document that requires users to correct discrepancies in their taxpayer identification number (TIN) to avoid backup withholding. This guide provides clear instructions to assist users in filling out the notice online.

Follow the steps to complete the NY First B Notice efficiently

- Click the ‘Get Form’ button to obtain the NY First B Notice, and open it in your preferred editor.

- Fill in the date next to 'Date:' in the top section of the notice. This date indicates when action is required to avoid backup withholding.

- Under 'Project:', enter the relevant project name associated with your account. This helps in identifying the specific task at hand.

- In the 'Task:' field, specify the task related to the notice for better clarity in communications.

- In the 'Award:' section, provide the award number or description connected to your account, ensuring accuracy and relevance.

- Fill in the section titled 'Current Name on Account:' with the name exactly as it appears on your social security card or tax documents.

- In the 'Current TIN on Account:' field, enter the taxpayer identification number as recorded by the IRS or the Social Security Administration.

- Review the instructions provided in the notice carefully to determine if any additional actions are required based on discrepancies between your account and IRS records.

- If applicable, complete the attached Form W-9 based on the instructions within the notice, ensuring that you sign the form before submitting it.

- Once all necessary fields are completed, save your changes. You can also choose to download, print, or share the filled notice as needed.

Ready to complete your forms online? Start filling out the NY First B Notice now.

B notices are issued by the IRS as part of their efforts to maintain accurate tax records. Specifically, the NY First B Notice is sent to payers when discrepancies in taxpayer information are detected. The responsibility to address these notices falls on the payers and the recipients involved. With the right guidance, such as that available through US Legal Forms, dealing with B notices can become a straightforward process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.