Loading

Get Boe-305-ah P1 Rev 08 01-15 Assessment Appeal Application

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the BOE-305-AH P1 REV 08 01-15 assessment appeal application online

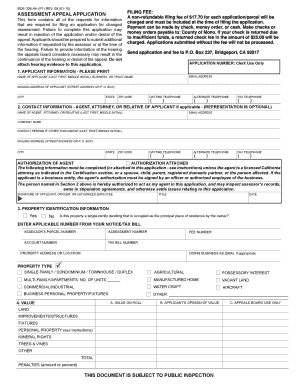

Filing an assessment appeal application is a critical step for property owners seeking to challenge their property assessments. This guide will provide clear and comprehensive instructions on how to successfully complete the BOE-305-AH P1 REV 08 01-15 assessment appeal application online.

Follow the steps to accurately complete your assessment appeal application.

- Press the ‘Get Form’ button to access the application form and open it for editing.

- In Section 1, 'Applicant Information,' provide your name, mailing address, and contact numbers. Ensure that all information matches what is on your assessment notice.

- If you're represented by an agent, attorney, or relative, complete Section 2 with their details. Include their authorization if applicable.

- In Section 3, 'Property Identification Information,' enter the assessors parcel number and property details, ensuring correctness to facilitate the assessment appeal process.

- Fill out Section 4, 'Value,' by entering the assessed values from your notice. In column B, provide your opinion on the property’s value for each applicable category.

- For Section 5, 'Type of Assessment Being Appealed,' check only one box that reflects the type of assessment.

- In Section 6, 'Reason for Filing Appeal,' indicate your reasons for the appeal by checking the relevant boxes and providing additional details if necessary.

- Decide whether to request written findings of facts in Section 7, and check the appropriate box.

- Finally, in Section 8, indicate if you want to designate the application as a claim for refund and certify the application by providing your signature and date.

- Review all filled out sections for accuracy and completeness. Once satisfied, save your changes, then download, print, or share the completed form as required.

Start completing your assessment appeal application online today for a successful filing process.

To protect your appeal rights, you must file your property tax appeal with the County Board of Tax Assessors within 45 days of the date the Assessment Notice was mailed. Do not send your appeal form to the Department of Revenue.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.