Get Sba 1368 2012-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SBA 1368 online

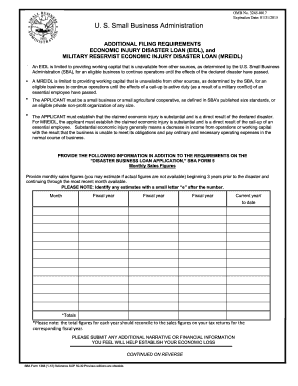

The SBA 1368 is an important form for businesses seeking economic injury disaster loans and military reservist economic injury disaster loans. This guide will provide clear and concise instructions for completing the form online, ensuring users navigate the process efficiently.

Follow the steps to complete the SBA 1368 online

- Press the ‘Get Form’ button to access the SBA 1368 and open it in the online editor.

- Begin by entering your business's monthly sales figures. Start from three years prior to the disaster and continue through the most recent month available. If you are estimating, be sure to mark these figures with a small letter 'e' after the number.

- Fill out the fiscal year and month for each of the reported sales figures to ensure accuracy.

- Provide totals for each fiscal year as required. Ensure that these totals reconcile with the sales figures reported on your tax returns.

- Include any additional narrative or financial information that could further establish your economic loss, supporting your application.

- Optionally, you may provide a financial forecast that illustrates expected income and expenses during the affected period until normal operations resume. This step is not required.

- Review all the information entered for accuracy and clarity before finalizing.

- Once you have completed the form, you can save changes, download, print, or share the completed form as needed.

Complete your SBA 1368 online today to ensure your business can secure the funding it needs.

SBA disaster loans, including those referenced in SBA 1368, typically do not get forgiven. These loans operate under a repayment structure designed to assist you in recovering from economic setbacks. However, it's essential to explore various relief options that might be available to you. For instance, Supplemental Economic Injury Disaster Loans (EIDL) could provide additional support during challenging times.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.