Loading

Get Why Surcharge Form Fill In Bank

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Why Surcharge Form Fill In Bank online

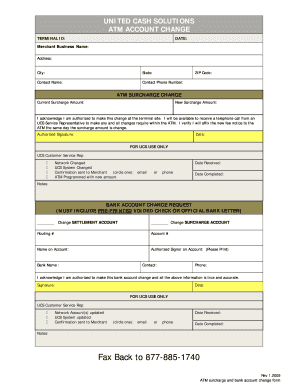

Filling out the Why Surcharge Form Fill In Bank is an important process for ensuring that any changes to your ATM surcharge and bank account details are accurately recorded. This guide provides clear instructions for each component of the form to help users complete it successfully.

Follow the steps to accurately complete the form.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Locate the 'terminal ID' field and enter the unique identifier for the ATM terminal.

- Enter the 'date' on which you are filling out the form.

- In the 'merchant business name' field, provide the name of your business.

- Fill out the address section including street address, city, state, and ZIP code.

- Provide your 'contact name' and 'contact phone number' for follow-up communication.

- Under the 'ATM surcharge change' section, enter the new surcharge amount in the specified field.

- Record the current surcharge amount to document the change.

- Acknowledge your authorization to make the change by signing in the 'authorized signature' field and adding the date.

- For the bank account change request, specify if you are changing the settlement or surcharge account.

- Provide the routing number, account number, name on account, and authorized signor information.

- Sign and date where indicated to confirm that all information is true and accurate.

- Once completed, users can save changes, download the document, or print it for sharing.

Complete your documents online for a smoother process.

A surcharge is an extra fee or tax added to the customer's final bill for paying through check, credit, or debit card rather than cash. The additional sum reflects the extra services offered by the merchant, increased product costs, or government regulatory costs.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.