Get Cfpb H-24(a) 2014-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CFPB H-24(A) online

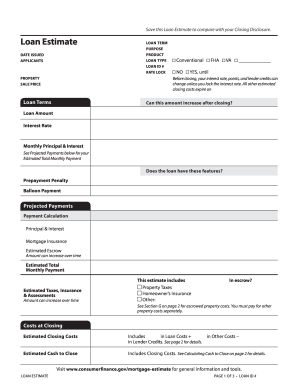

The CFPB H-24(A), also known as the Mortgage Loan Transaction Loan Estimate, is an essential document that helps users understand the costs associated with a loan. This guide provides step-by-step instructions on how to effectively fill out the form online to ensure all necessary information is accurately captured.

Follow the steps to complete the CFPB H-24(A) online.

- Press the ‘Get Form’ button to obtain the CFPB H-24(A) Loan Estimate form and open it in your preferred online editor.

- Begin by filling out the loan term, purpose, product, loan type, loan ID number, and rate lock status. Ensure that all information matches your loan agreement to avoid discrepancies.

- Enter the date issued and complete the applicants' information, including names and contact details. This section is crucial for identifying the individuals applying for the loan.

- Provide the property details and estimated sale price. Ensure that the value you enter reflects the market assessment of the property.

- Fill out the loan terms section, clearly stating the loan amount and interest rate. Indicate if the loan carries any features such as prepayment penalties or balloon payments.

- Complete the projected payments section by detailing the principal, interest, estimated escrow, and other costs associated with the loan. This section helps in understanding the expected monthly payment.

- In the closing costs section, provide detailed estimates of various costs associated with finalizing the mortgage. This includes origination charges, appraisal fees, prepaid expenses, and other government fees.

- Ensure that all calculations are accurate, particularly regarding cash to close, as this is essential for the completion of the loan process.

- Once all sections are filled out, review the entire document for accuracy and completeness. Make any necessary corrections to ensure all information is correct.

- After finalizing the document, you can save changes, download, print, or share the completed form as needed.

Complete your CFPB H-24(A) form online today to streamline your mortgage process.

The monthly payment for a $300,000 mortgage over 30 years significantly depends on the interest rate. For example, at a 3% interest rate, the monthly payment would be approximately $1,264, while a 4% interest rate could raise that amount to around $1,432. It's essential to consider these values in the context of the CFPB H-24(A) to understand your total repayment obligations. For personalized calculations, platforms like U.S. Legal Forms can guide you in analyzing various mortgage scenarios effectively.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.