Loading

Get Use Form Nyc399z

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the USE FORM NYC399Z online

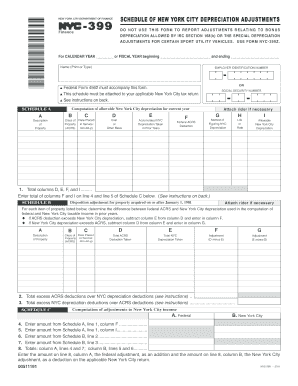

Filling out the USE FORM NYC399Z accurately is essential for reporting adjustments to New York City depreciation. This guide provides a clear, step-by-step approach to help users navigate the form effectively.

Follow the steps to complete the USE FORM NYC399Z online.

- Click ‘Get Form’ button to download the form and open it in your preferred editor.

- Begin with Section A, where you will need to provide a brief description of the property. It is important to be precise to ensure proper reporting.

- In the next field, indicate the class of property using the classifications similar to those used for federal ACRS deductions. This helps in identifying how the property is categorized for depreciation purposes.

- Enter the date the property was placed in service in the specified format (mm-dd-yy). Accurate dates are crucial for determining the depreciation eligibility.

- In the following fields, input the cost or other basis of the property as well as any accumulated New York City depreciation taken in prior years. Be diligent while entering these amounts to reflect accurate history.

- Calculate and enter the allowable New York City depreciation in the designated fields. Reference the previous year’s federal deductions, as this is relevant for determining any necessary adjustments.

- If you need more space, attach a rider to provide additional property items and their respective details, ensuring that no entry is omitted.

- Finally, review all entries to confirm accuracy. Save any changes made, and download or print the completed form. Ensure to share or submit it as needed according to your filing requirements.

Complete your documents online efficiently and ensure all information is accurately reported.

A business can deduct up to $1 million in the year the equipment is first bought or leased. Bonus deductions are available until 2022 for equipment that exceeds the deduction limit. The deduction is taken before the bonus. The Section 179 Deduction covers new and used equipment.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.