Loading

Get Itr-1 Request For Tax Clearance Taxpayer Assistance - 8 26 232

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ITR-1 Request For Tax Clearance Taxpayer Assistance - 8 26 232 online

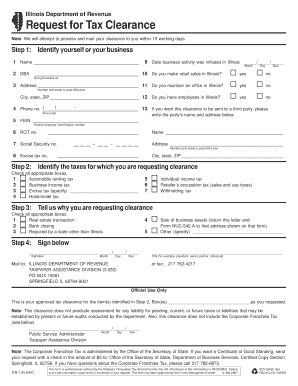

The ITR-1 Request For Tax Clearance Taxpayer Assistance - 8 26 232 is a crucial document for individuals and businesses seeking tax clearance in Illinois. This guide provides step-by-step instructions to help you complete this form accurately and efficiently online.

Follow the steps to successfully fill out your tax clearance request.

- Click the ‘Get Form’ button to obtain the ITR-1 form and open it in your preferred editor.

- Begin by identifying yourself or your business. Fill in your name, date when business activity was initiated, DBA (doing business as), address, phone number, federal employer identification number (FEIN), retailer's occupation tax number (ROT), social security number, and excise tax number.

- Next, identify the taxes for which you are requesting clearance. Check all the applicable boxes that pertain to your situation, including automobile renting tax, business income tax, excise tax, hotel/motel tax, individual income tax, retailer’s occupation tax, and withholding tax.

- Indicate the reason you are requesting tax clearance. Review the list of reasons and check all that apply, including real estate transaction, bank closing, state requirement, sale of business assets, and any other specified reason.

- Finally, sign the form, providing your title (e.g., president, owner, partner, individual) along with the date of signing.

- After completing the form, you can save your changes, download, print, or share the form as needed.

Complete and submit your ITR-1 Request For Tax Clearance online to ensure a smooth processing of your request.

The Illinois Department of Revenue (IDOR) sends letters and notices to request additional information and support for information you report on your tax return, or to inform you of a change made to your return, balance due or overpayment amount.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.