Loading

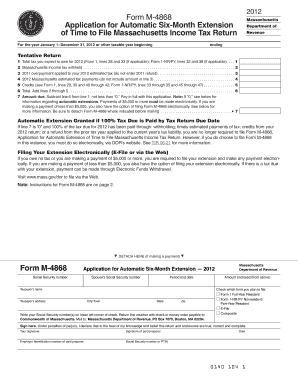

Get Form M-4868 Bapplicationb For Automatic Six-month Extension Of Time Bb - 8 26 232

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form M-4868 application for automatic six-month extension of time online

Filing for an extension on your Massachusetts income tax return can be straightforward with the right guidance. This guide will provide you with step-by-step instructions on how to complete the Form M-4868 online, ensuring you understand each section of the form.

Follow the steps to complete your extension application online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your social security number in the designated field. Ensure the number is accurate to avoid delays.

- For joint applications, include your partner's social security number in the provided field.

- Specify the tax period end date, typically December 31 of the tax year you are applying for.

- Input your name and address in the designated areas. Ensure this information matches the details in your tax records.

- Indicate the total tax you expect to owe for the current year. This will usually come from your completed tax forms.

- List any Massachusetts income tax withheld that is applicable. This will also be found on your tax forms.

- Account for any overpayments from the prior year's taxes that you wish to apply to this year's estimated tax.

- Include any estimated tax payments made for the current year, not including amounts reported in previous lines.

- Calculate and enter any credits you are eligible for based on your prior filings.

- Sum the values you have entered to arrive at the total anticipated income tax liability.

- If there is a balance due, subtract your total from the expected tax owed and enter this amount. Payment instructions will follow if applicable.

- Select the form you plan to file (Form 1 for full-year residents or Form 1-NR/PY for nonresidents/part-year residents).

- Provide your signature, affirming the accuracy of the information provided, as well as the date of signing.

- Review all entered information for accuracy, then save your changes. You can choose to download, print, or share the completed form as needed.

Complete your Form M-4868 application online today to secure your tax extension.

If you are not able to file your return by the due date, you generally can get an automatic 6-month extension of time to file (but not of time to pay). To get this automatic extension, you must file a paper Form 4868 or use IRS efile (electronic filing).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.