Loading

Get Texas Sales And Use Tax Return Short Form - 8 26 232

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Texas Sales And Use Tax Return Short Form - 8 26 232 online

Filling out the Texas Sales And Use Tax Return Short Form - 8 26 232 online can streamline your tax reporting process. This guide provides a clear and straightforward approach to help you complete each section of the form accurately and efficiently.

Follow the steps to complete your tax return online.

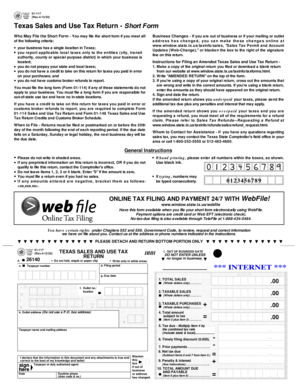

- Click ‘Get Form’ button to obtain the form and open it in your editor.

- Enter your taxpayer number, which is required to identify your business on the form.

- Fill in the filing period; ensure it corresponds with the reporting period for which you are filing.

- Provide your total sales for the reporting period in Item 1. Enter only whole dollars.

- Input the taxable sales in Item 2, which should also be in whole dollars.

- In Item 3, enter any taxable purchases made during the reporting period.

- Calculate the total amount subject to tax by adding Items 2 and 3, and enter it in Item 4.

- Multiply the amount in Item 4 by the combined tax rate applicable to your business to find the tax due, and enter this amount in Item 5.

- If applicable, enter any prior payments made in Item 7 and calculate the net tax due by subtracting Items 6 and 7 from Item 5 and entering this amount in Item 8.

- Include any penalties and interest as indicated in Item 9, then calculate the total amount due and payable by adding Item 8 and Item 9, and record the total in Item 10.

- Review all entered information for accuracy and make necessary corrections before final submission.

- Once complete, save your changes, then download, print, or share the form as required.

Start completing your Texas Sales And Use Tax Return online now.

You can use a resale certificate to purchase the following items tax free: taxable items (tangible personal property and taxable services) that you intend to resell in the form or condition in which you acquired it from your vendor or that you intend to resell as an integral part of other merchandise or taxable service.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.