Loading

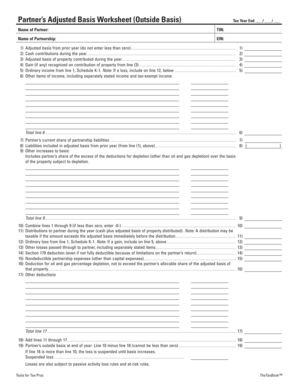

Get Partners Adjusted Basis Worksheet Outside Basis Tax Year

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Partners Adjusted Basis Worksheet Outside Basis Tax Year online

The Partners Adjusted Basis Worksheet Outside Basis Tax Year is an essential document for partners in a partnership to accurately report their adjusted basis for a particular tax year. Filling this form out online can streamline the process and ensure accuracy in reporting financial data.

Follow the steps to complete the Partners Adjusted Basis Worksheet online.

- Press the ‘Get Form’ button to access the worksheet and open it in your preferred editor.

- Enter the tax year end date in the specified format (MM/DD/YYYY). This is crucial as it determines the accounting period for your basis calculations.

- Fill in the 'Name of Partner' and 'TIN' fields to identify the individual partner completing the worksheet.

- Input the 'Name of Partnership' and 'EIN' to provide identification for the partnership involved.

- Record the adjusted basis from the prior year in the first row, ensuring not to enter a value less than zero.

- Document any cash contributions made during the year in the next row accurately.

- Report the adjusted basis of any property contributed during the year, ensuring to detail the value of such contributions.

- Indicate any gain recognized on the contribution of property in accordance with line (3) of the worksheet.

- Transfer any ordinary income from line 1 of Schedule K-1, remembering to include losses on line 12, if applicable.

- List other items of income, including separately stated income and tax-exempt income, in the corresponding rows.

- Sum total line 6 of your worksheet accurately to compute the total income and contributions.

- Fill in your current share of partnership liabilities and any liabilities included from the adjusted basis of the prior year.

- Identify any other increases to your basis, particularly involving deductions and depletions, in the designated area.

- Combine all entries from lines 1 through 9 and ensure that if the total is less than zero, you enter -0-.

- Document any distributions received during the year, accounting for both cash and property adjustments.

- Enter any ordinary loss from line 1 of Schedule K-1 and report on potential gains alongside.

- Summarize nondeductible partnership expenses that may impact your overall financial report.

- Calculate deductions for oil and gas percentage depletion, ensuring it does not exceed your allocated share.

- Total all deductions for line 17 accurately and combine these with previous totals from lines 11 through 17.

- Calculate your partner’s outside basis at the end of the year by subtracting the total from line 18 from line 10, ensuring the value cannot be less than zero.

- Review for any suspended losses and ensure compliance with loss reporting regulations.

- Once completed, save your changes, then download, print, or share the form as needed.

Start filling out your Partners Adjusted Basis Worksheet online for accurate tax reporting.

A partner's outside basis can never be less than zero. This means that if the liability the partnership assumes is more than the basis of the asset, the contributing partner must recognize a gain to bring his/her outside basis to zero.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.