Loading

Get Request For Settlement Taxtrash Information

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Request For Settlement TaxTrash Information online

Filling out the Request For Settlement TaxTrash Information form online can seem daunting, but with careful guidance, you can complete it accurately and efficiently. This guide will walk you through each section of the form to ensure you provide all necessary information.

Follow the steps to complete the form successfully.

- Press the ‘Get Form’ button to access the document and open it in your browser.

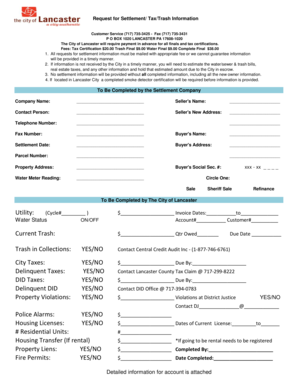

- In the section labeled 'To Be Completed by the Settlement Company', fill in the company name, seller's name, contact person, seller's new address, telephone number, and fax number.

- Complete the buyer's information including their name, settlement date, address, parcel number, and property address. Remember to include the water meter reading.

- Indicate the buyer's social security number and circle the appropriate option for the type of transaction: Sale, Sheriff Sale, or Refinance.

- In the section 'To Be Completed by The City of Lancaster', review the status of the utility service and fill in invoice dates, account number, and customer number.

- Complete the current trash and due date sections, along with any relevant notes about trash in collections, city taxes, and delinquent taxes.

- Mark any property violations and complete the additional sections regarding police alarms, housing licenses, residential units, property liens, and fire permits as applicable.

- Once all sections are completed, make sure to save your changes, download the document, print a copy, or share it as necessary.

Complete your Request For Settlement TaxTrash Information form online for a smooth and efficient process.

The party that pays a taxable settlement or judgment to the injured party and/or their attorney will issue a Form 1099-MISC, Form 1099-NEC, or W-2 to report the settlement. In some cases, the claimant and attorney are issued separate 1099s reporting the same settlement dollars.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.