Loading

Get Chaps Transfer

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Chaps Transfer online

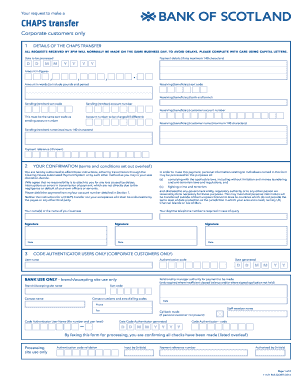

This guide provides a comprehensive overview of completing the Chaps Transfer form online, specifically tailored for corporate customers. Follow the steps outlined below to ensure accurate and timely processing of your transfer.

Follow the steps to complete your Chaps Transfer form.

- Click ‘Get Form’ button to access the Chaps Transfer form and open it in your preferred digital editor.

- Fill in the date to be processed in the designated section, using the format DD/MM/YYYY.

- Provide the payment details if necessary, adhering to the 140 character maximum limit.

- Enter the amount in figures and ensure that the total matches the amount provided in words, including pounds and pence.

- Input the receiving beneficiary's sort code and customer account number. It is essential that the sort code aligns with the sending account number.

- List the receiving beneficiary's bank and branch information.

- Complete the sending remitter's sort code and account number accurately.

- Provide the names of both the sending remitter and receiving beneficiary, ensuring each name does not exceed 140 characters.

- If known, include a payment reference in the appropriate section.

- Review all previously entered information carefully to avoid delays.

- After confirming the details, save changes to your document, or if required, download, print, or share the form as needed.

For a smooth and efficient process, complete your Chaps Transfer documents online right away.

The key difference between CHAPS and SWIFT (or the Society for Worldwide Interbank Financial Telecommunication) payments is the international factor. CHAPS can only be used to transfer sterling, whereas SWIFT payments can be used to transfer different currencies all over the world.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.