Loading

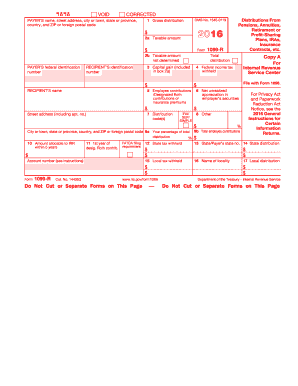

Get 2016 Form 1099-r

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2016 Form 1099-R online

Filling out the 2016 Form 1099-R can be straightforward when you follow a structured approach. This guide provides step-by-step instructions to assist users in accurately completing the form online.

Follow the steps to fill out the form correctly.

- Click the ‘Get Form’ button to access the 2016 Form 1099-R and open it in your preferred editor.

- In the first section, enter the payer’s name, street address, city, state, and ZIP code. Ensure accuracy, as this information identifies the source of the distribution.

- Fill in the payer’s federal identification number, which is essential for the IRS records.

- Input the recipient's identification number and their name, including the complete street address and city or town.

- Complete the gross distribution amount in box 1, which reflects the total amount distributed by the retirement plan.

- In box 2a, record the taxable amount of the distribution. If this can't be determined, check box 2b.

- Report any federal income tax withheld in box 4 and any applicable state tax withheld in box 12.

- Fill out any additional relevant sections such as capital gains in box 3 and other fields as they apply to the distribution.

- Once all applicable sections are complete, review the information for accuracy.

- Finally, save your changes. You can choose to download, print, or share the completed form as needed.

Complete your 2016 Form 1099-R online today to ensure accurate reporting of your financial distributions.

You should receive a Form 1099-R that tells you exactly how much you withdrew from your retirement plan and how much tax was withheld, if any. When you e-file with eFile.com, the tax app will report these amounts directly on your Form 1040 and help you report the 10% penalty as applicable.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.