Loading

Get Fatca - Crs Declaration Form - Entities2cdr

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FATCA - CRS Declaration Form - Entities2cdr online

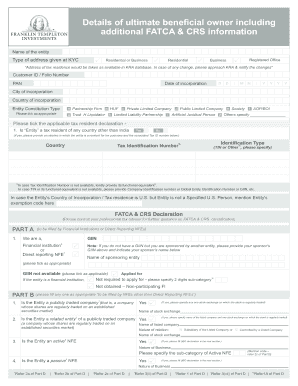

This guide provides a step-by-step approach to completing the FATCA - CRS Declaration Form - Entities2cdr online. Designed to assist users with varying levels of legal experience, this document aims to clarify key components and instructions for accurate submission.

Follow the steps to complete your declaration form successfully.

- Use the ‘Get Form’ button to access the declaration form and open it in the editor.

- Begin by entering the name of the entity as registered.

- Provide the type of address used in your KYC documentation—choose either 'Residential' or 'Business'.

- Fill in the entity's Customer ID or Folio Number.

- Input the PAN and the date of incorporation in the specified format.

- Indicate the city and country of incorporation.

- Select the entity constitution type by ticking the appropriate option from the provided list.

- Respond to the tax residency declaration questions by indicating if the entity is a tax resident of any country other than India and providing relevant details if applicable.

- Fill in the Identification Type and Tax Identification Number, including any alternatives if TIN is not available.

- Complete the FATCA & CRS Declaration sections according to your entity type, specifying if you are a financial institution or a non-financial entity.

- Provide details for beneficial owners and controlling persons in the UBO Declaration section, ensuring all tax residency, identification numbers, and interests are listed.

- Lastly, review all information carefully, then save your changes, download, print, or share the completed form as needed.

Start filling out your FATCA - CRS Declaration Form - Entities2cdr online today!

This process is called “self-certification” and we are required to collect this information under the CRS. Is everyone doing this? All financial institutions – that includes banks, insurers and asset management businesses – in participating countries (including Australia) are required to be compliant with the CRS.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.