Loading

Get Canada Gst/hst Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada GST/HST Return online

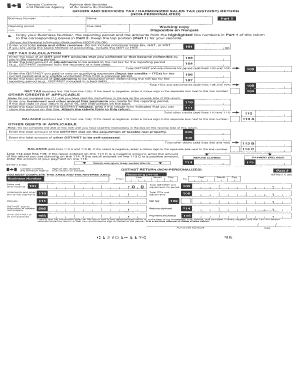

The Canada GST/HST Return is a vital document for businesses registered for goods and services tax/harmonized sales tax. This guide provides clear instructions to help users navigate the online form effectively and ensure accurate submissions.

Follow the steps to complete your Canada GST/HST Return online.

- Click ‘Get Form’ button to access the GST/HST Return form and open it in your chosen online platform.

- Fill in your business number. This unique identifier is essential for processing your return.

- Indicate the reporting period for your return. Select the correct time frame that covers your sales and purchases.

- Enter total sales and other revenue amounts for the period. Ensure to include any applicable taxes collected.

- Report your total input tax credits for the purchases you made during the reporting period.

- Calculate your net tax by subtracting your input tax credits from the taxes collected.

- Complete any additional fields as necessary, such as adjustments or specific circumstances that may apply.

- Review all entries for accuracy and completeness to avoid delays in processing your return.

- Save your changes, and choose to download, print, or share the completed form as needed.

Complete your Canada GST/HST Return online today for a streamlined filing experience.

Related links form

Filing a GST annual return involves several steps, starting with gathering your records of sales and expenses. Complete the T2 return form or the relevant GST return form based on your business structure. Review your financial information thoroughly before submitting your Canada GST/HST Return to the CRA, ensuring all data is accurate and complete.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.