Get Sba 413 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SBA 413 online

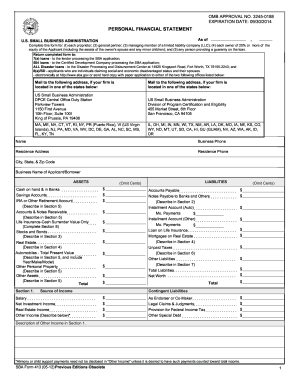

The SBA Form 413, also known as the Personal Financial Statement, is a crucial document for individuals applying for Small Business Administration loans. This guide provides clear, step-by-step instructions on how to accurately fill out the SBA 413 online, ensuring you provide all necessary information for your application.

Follow the steps to complete the SBA 413 online form effectively.

- Press the ‘Get Form’ button to access the form and open it in your selected PDF editor.

- Begin by entering your personal information, including your name, business phone number, residence address, and residence phone number.

- Fill in the business name of the applicant or borrower as requested.

- Proceed to the assets section, where you will list various assets such as cash, savings accounts, life insurance, stocks, and real estate. Ensure to provide accurate values.

- In the liabilities section, detail all debts and liabilities, including accounts payable, notes payable, mortgages, and any unpaid taxes.

- Complete the income section, listing your sources of income like salary, investments, and rental income. Include any other types of income in the designated areas.

- If applicable, describe your contingent liabilities separately in the corresponding section.

- Attach any necessary documentation or additional information as indicated by the sections for notes payable, stocks and bonds, and real estate owned.

- Review all sections for completeness and ensure the information provided is accurate.

- Upon completion, you can save changes, download the form for your records, print it, or share it as required.

Complete your SBA 413 form online to streamline your loan application process.

Get form

Filling out a US declaration form involves providing specific information about your financial and personal details. You must ensure that all responses are truthful and accurate to avoid legal repercussions. The details you provide may help support your case or application. Use US Legal Forms for tailored templates that guide you through the completion of this form.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.