Loading

Get Computation And Payment Form For Income Support Levy Under - Pakcustoms

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Computation And Payment Form For Income Support Levy Under - Pakcustoms online

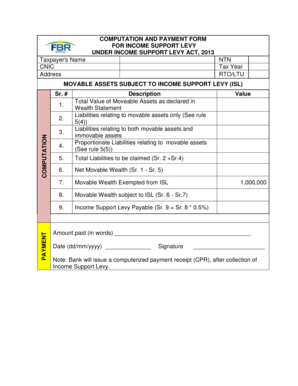

Filling out the Computation And Payment Form for the Income Support Levy is essential for individuals to ensure compliance with the Income Support Levy Act, 2013. This guide will provide you with clear, step-by-step instructions on how to accurately complete the form online.

Follow the steps to accurately complete the form.

- Click ‘Get Form’ button to access the Computation And Payment Form and open it for editing.

- Fill in your personal information at the top of the form, including your taxpayer's name, CNIC number, address, NTN, tax year, and RTO/LTU information. Ensure all details are accurate to prevent any issues with your submission.

- In the section titled 'Movable Assets Subject to Income Support Levy (ISL)', list the total value of your movable assets as declared in your Wealth Statement in the designated field.

- Next, input liabilities related to movable assets only in the corresponding space. Follow rule 5(4) to understand what qualifies as these liabilities.

- You will also need to state liabilities that relate to both movable and immovable assets. This helps define your overall financial position.

- Calculate the proportionate liabilities relating to movable assets as specified in rule 5(5) and enter that figure in the provided space.

- Sum these liabilities together and enter this total in the 'Total Liabilities to be claimed' section (Sr. 2 + Sr. 4).

- To calculate your net movable wealth, subtract the total liabilities from your total movable assets (Sr. 1 - Sr. 5) and fill in this amount.

- Next, indicate any movable wealth that is exempted from the Income Support Levy. This amount will be subtracted from your net movable wealth.

- Finally, calculate the movable wealth that is subject to the Income Support Levy by subtracting the exempted amount from the net movable wealth (Sr. 6 - Sr. 7).

- Determine the Income Support Levy payable by multiplying the amount subject to ISL by 0.5% (Sr. 8 * 0.5%).

- After completing all fields, state the amount paid in words, enter the date of payment, and provide your signature to validate the form.

- Review all information for accuracy, then proceed to save changes, download a copy, print, or share the completed form as necessary.

Complete your Computation And Payment Form online to ensure compliance with the Income Support Levy requirements.

Levels rise with aging and are higher in older females than males. Elevated levels of cortisol in aging are associated with higher levels of psychosocial stress, poorer cognitive performance, and atrophy of memory-related structures in the brain such as the hippocampus.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.