Loading

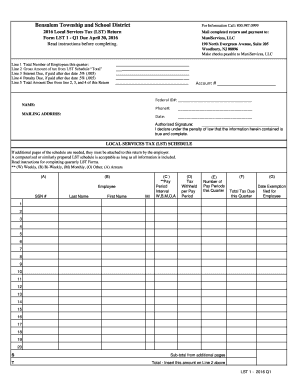

Get 2016 Local Services Tax (lst) Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2016 Local Services Tax (LST) Return online

Filing your 2016 Local Services Tax (LST) Return online is an important task for businesses and organizations. This guide will walk you through the process of completing the form accurately and efficiently, ensuring compliance with local regulations.

Follow the steps to complete your LST Return confidently.

- Click ‘Get Form’ button to obtain the form and open it.

- Begin by entering your account number in the designated field to ensure your return is linked to the correct business.

- Provide your federal identification number in the appropriate section, ensuring the information is accurate.

- Fill out your name and mailing address clearly, as this information will be used for communicating about your tax return.

- Enter your phone number in the designated area for any necessary follow-up contact.

- In the section labeled 'Total Number of Employees this quarter', input the total count of employees for the quarter being reported.

- Complete the Gross Amount of Tax from the LST Schedule by entering the total tax calculated from the attached schedule.

- If applicable, calculate the interest due for late payments at the rate of 0.5% and enter that number.

- Likewise, include any penalties due, also calculated at the 0.5% rate for late submissions.

- Calculate the Total Amount Due by summing the values from lines 2, 3, and 4 of the return.

- Make sure to complete the 'Authorized Signature' section and date your return.

- After reviewing all entries for accuracy, save your changes, and proceed to download, print, or share the completed form.

Complete your LST Return online to ensure timely compliance with your local tax obligations.

Pennsylvania law requires withholding at a rate of 3.07 percent on non-wage Pennsylvania source income payments made to nonresidents. Withholding of payments that are less than $5,000 during the calendar year are optional and at the discretion of the payor.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.