Loading

Get Business Privilege Mercantile Tax Return Bensalem

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the BUSINESS PRIVILEGE MERCANTILE TAX RETURN BENSALEM online

Filing the Business Privilege Mercantile Tax Return for Bensalem is a crucial requirement for businesses operating within the township. This guide provides clear, step-by-step instructions to assist you in completing the form accurately and efficiently in an online format.

Follow the steps to complete your tax return online.

- Press the ‘Get Form’ button to access the Business Privilege Mercantile Tax Return form and open it for editing.

- Fill in your business address in the designated area. Ensure that all information is accurate and up to date.

- Enter the name of the business in the appropriate field. This should match the registered name of your business.

- Provide your Tax Identification Number (TIN) in the section marked for that purpose.

- Input your MuniServices Account number in the specified area.

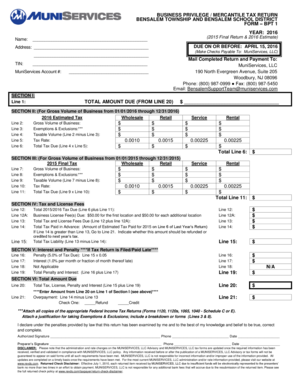

- Complete Section I by entering the total amount due from Line 20 of the subsequent sections.

- Move to Section II for the gross volume of business during the 2016 period. Complete the necessary lines, including gross volume, exemptions, taxable volume, tax rate, and total tax due.

- Continue to Section III to report the gross volume of business from 2015. Ensure to fill in analogous information regarding gross volumes, exemptions, and taxes due.

- In Section IV, detail the tax and license fees due. Include any business license fees according to the number of locations you operate.

- If applicable, fill out Section V regarding interest and penalties for late filing. Follow the specific calculations outlined.

- In Section VI, summarize the total amount due, combining all taxes, fees, penalties, and interest. Enter the calculations accurately.

- Finally, review all entered information for accuracy. Once verified, you can save changes, download a copy for your records, print it, or share it electronically.

Complete your Business Privilege Mercantile Tax Return online today for a smooth filing experience.

Businesses subject to the mercantile tax are required to pay a tax to Upper Merion Township each year equal to 1.5 mills (. 0015), or $1.50 for every $1,000 in gross receipts. In addition, each business must pay an annual $25 business license fee.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.