Loading

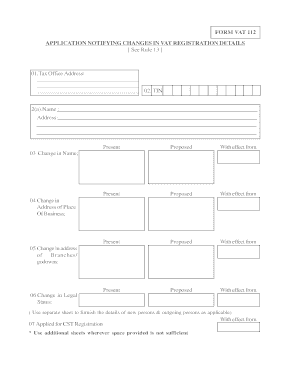

Get Form Vat 112 Application Notifying Changes In V At

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FORM VAT 112 APPLICATION NOTIFYING CHANGES IN VAT online

Filling out the FORM VAT 112 is an essential process for notifying changes in VAT registration details. This guide provides clear, step-by-step instructions to assist users in completing the form online efficiently and accurately.

Follow the steps to complete the form correctly.

- Press the ‘Get Form’ button to retrieve the form and open it in your preferred editor.

- In the first section, enter your tax office address. Ensure all address sections are filled out accurately.

- If you have commenced or stopped executing work contracts for government or local authorities, provide the relevant dates in the specified sections.

- After completing all sections, save your changes. You can then download, print, or share the completed form as needed.

Start filling out your FORM VAT 112 online today to ensure your VAT registration details are up to date.

Related links form

Form D-1 means that those material purchased by purchaser only used for manfucaturing, packing, works contractor etc and form C-4 means sales has been deposited the sales tax against issued invoices.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.