Loading

Get Form 50 117

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 50 117 online

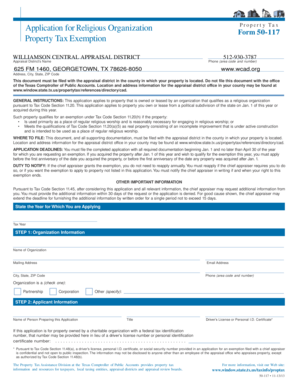

Navigating the Form 50 117 for property tax exemption can be straightforward with the right guidance. This document serves as a step-by-step guide to assist you in filling out the form online efficiently and accurately.

Follow the steps to complete your Form 50 117 application online.

- Press the ‘Get Form’ button to acquire the document and open it in your preferred editor.

- Indicate the tax year for which you are applying by entering the year in the designated field.

- Fill in the organization information, including the name, mailing address, email address, city, state, ZIP code, and phone number. Select the type of organization by checking the appropriate box (Partnership, Corporation, or Other).

- Complete the applicant information section by providing the name of the person preparing the application, their title, and either a driver’s license number or federal tax identification number, if applicable.

- In the property information section, make sure to attach one Schedule AR form for each parcel of real property, one Schedule BR form for personal property, and one Schedule LR form for each parcel of land subject to exemption.

- Answer the organization questions honestly. Attach relevant charters, bylaws, or governing documents as required.

- Review the certification and signature section. Provide the printed name, title, authorized signature, and date of signing.

- Once all sections are filled, save your changes, download the completed form, print it, or share it as necessary.

Complete your Form 50 117 application online today and ensure you secure your property tax exemption.

For persons age 65 or older or disabled, Tax Code Section 11.13(c) requires school districts to provide an additional $10,000 residence homestead exemption. Tax Code Section 11.13(d) allows any taxing unit to adopt a local option residence homestead exemption. This local option exemption cannot be less than $3,000.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.