Loading

Get State Of South Carolina I-335 - Webservicesfpblscsoftcomb

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the STATE OF SOUTH CAROLINA I-335 - Webservicesfpblscsoftcomb online

Filling out the STATE OF SOUTH CAROLINA I-335 form can seem daunting, but this guide provides clear and straightforward instructions to help you navigate each section effectively. Whether you are experienced or a novice, this guide will support you in completing the form accurately.

Follow the steps to successfully complete the I-335 form online.

- Press the ‘Get Form’ button to obtain the form and open it in your online environment.

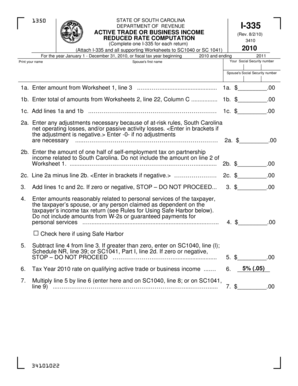

- Begin by completing your name and the name of your spouse at the top of the form, followed by entering your Social Security number and your spouse's Social Security number.

- For line 1a, enter the amount from Worksheet 1, line 3; for line 1b, sum the amounts from Worksheets 2, line 22, Column C. Finally, calculate line 1c by adding the amounts from lines 1a and 1b.

- On line 2a, include any necessary adjustments related to at-risk rules or losses, entering a negative adjustment in brackets if applicable. For line 2b, input one half of the self-employment tax associated with partnership income.

- Calculate line 2c by subtracting line 2b from line 2a. For line 3, if the result is zero or negative, discontinue. If positive, sum lines 1c and 2c.

- On line 4, enter the amounts related to personal services. Declare if you are using Safe Harbor by checking the corresponding box next to this line.

- Subtract line 4 from line 3 for line 5; if positive, this is the amount to reference on SC1040 or SC1041 as required.

- For line 6, enter the reduced rate for active trade or business income, which is 5%. Multiply the number from line 5 by the rate on line 6 for line 7. This is your tax amount to report on SC1040, line 8 or SC1041, Part I, line 9.

- Once all fields are complete, you can save your changes, download the form for your records, print it for submission, or share it as needed.

Complete your STATE OF SOUTH CAROLINA I-335 form online today to ensure timely processing and compliance.

Self employment taxes are comprised of two parts: Social Security and Medicare. You will pay 6.2 percent and your employer will pay Social Security taxes of 6.2 percent on the first $128,400 of your covered wages. You each also pay Medicare taxes of 1.45 percent on all your wages - no limit.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.