Loading

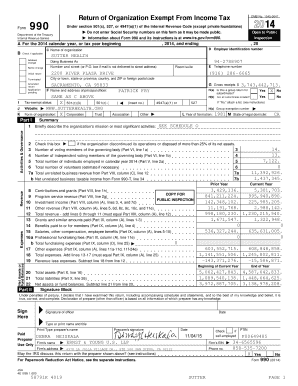

Get Form 990 Return Of Organization Exempt From Income Tax Form 990 Return Of Organization Exempt From

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 990 Return Of Organization Exempt From Income Tax online

Filing the Form 990 is essential for organizations exempt from income tax to report financial information and activities. This guide provides a clear, step-by-step approach to help users complete the form online accurately and efficiently.

Follow the steps to fill out Form 990 seamlessly.

- Click ‘Get Form’ button to access the Form 990 document and open it in the editor.

- Enter the employer identification number in the designated field (line D). This number is essential for identifying your organization.

- Provide the organization’s mailing address. Use line G for any changes to previous information, if applicable.

- Detail your organization’s mission or major activities in the provided space (line O). This clarifies the organization's purpose.

- Complete the financial section, entering total revenue and expenditures as outlined in the various parts, including Part I and Part IX.

- Review all data entered for accuracy, ensuring your entries throughout the form correlate correctly with your financial statements.

- Finalize your filing by saving your completed Form 990, and consider downloading it for your records. You may also choose to print or share the form as needed.

Take action now and file your Form 990 online to maintain compliance and transparency.

The 990 is the tax form the Internal Revenue Service (IRS) requires all 501(c)(3) tax-exempt charitable and nonprofit organizations to submit annually.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.