Loading

Get Annual Return Of Income And Tax Payable It05 Paye

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ANNUAL RETURN OF INCOME AND TAX PAYABLE IT05 PAYE online

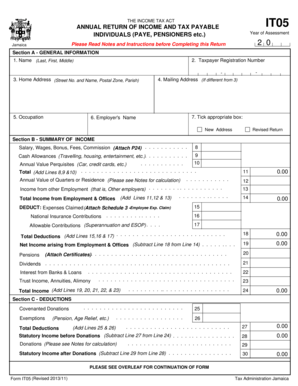

Filling out the ANNUAL RETURN OF INCOME AND TAX PAYABLE IT05 PAYE is an essential task for individuals who need to report their income and tax obligations. This guide will walk you through the process of completing this form online, ensuring you provide accurate information and meet your tax responsibilities.

Follow the steps to complete your income and tax return accurately.

- Click the ‘Get Form’ button to access the form and open it in your preferred editor.

- Begin with Section A - General Information. Enter your tax identification number, full name (last, first, middle), home address, mailing address (if different), occupation, and employer's name. Additionally, select whether this is a new address or a revised return.

- In Section B - Summary of Income, report your gross salary, wages, bonuses, fees, and commissions. Don’t forget to attach the required P24 form. Then, list any cash allowances you have received, the annual value of perquisites, and any income from other employers. Add these amounts to calculate the total income from employment and offices.

- Next, calculate the annual value of quarters, and input any claimed expenses along with allowable contributions and national insurance contributions in Section C - Deductions. Be sure to refer to attached schedules when necessary.

- Continue to Section D - Tax Computation. Here, identify any income that falls under the nil rate threshold and report dividend income. Ensure you apply the correct tax rates to compute your tax payable or refundable amounts.

- Lastly, in Section E, you must sign the declaration. This attests that the information provided is complete and accurate. If someone else prepared the form, they should complete the representative's details section.

- Once you have reviewed all sections for accuracy, save your changes, and choose to download, print, or share the completed form.

Start completing your ANNUAL RETURN OF INCOME AND TAX PAYABLE IT05 PAYE online today to ensure you meet your tax obligations.

Payroll tax and PAYE You do not have to collect payroll taxes through PAYE if you are self-employed and have no employees. Payroll taxes handled through PAYE include income tax and National Insurance contributions deducted from employees' pay and the employers' National Insurance paid by the business.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.