Loading

Get S04-it02-it03 2015 Rev -dec-2-2015 Designer

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the S04-IT02-IT03 2015 Rev -Dec-2-2015 Designer online

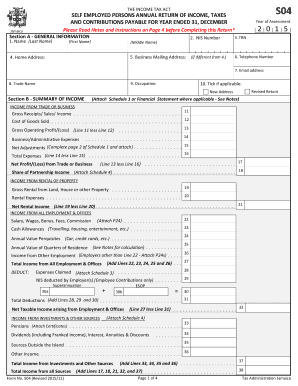

Filling out the S04-IT02-IT03 2015 Rev -Dec-2-2015 Designer form online is an essential task for self-employed individuals in Jamaica to report their income and obligations accurately. This guide provides comprehensive, step-by-step instructions to navigate each section of the form efficiently.

Follow the steps to successfully complete your form.

- Click the ‘Get Form’ button to obtain the S04-IT02-IT03 2015 Rev -Dec-2-2015 Designer form and open it in your online editor.

- Begin with Section A: General Information. Fill in your Taxpayer Registration Number (TRN), National Insurance Number (NIS), full name (last, first, middle), home address, business mailing address (if different), and contact details such as telephone number and email address. Mark the applicable checkboxes for Revised Return or New Address.

- Proceed to Section B: Summary of Income. Provide details about your income from trade or business, including gross receipts, cost of goods sold, and any business/administrative expenses. Utilize Schedule 1 where necessary for further breakdowns, particularly if gross receipts are under $3 million.

- Enter any income from rentals, including gross rental income and related expenses. Ensure to clearly differentiate normal repairs from improvements that cannot be claimed.

- Document your income from all employment and offices. Include salary, wages, bonuses, and any other compensations, ensuring P24s are attached as required.

- Move to Section C: Deductions and Statutory Income. Report any capital allowances, covenanted donations, and other exemptions that apply to your situation, ensuring documentation is attached for verification.

- In Section D: Available Losses, if applicable, report any losses carried forward or current losses, following the guidance notes provided.

- Complete Section E: Computation of Taxes & Contributions Payable. This section requires careful calculations of income tax payable, education tax, and NIS contributions based on previous inputs. Ensure all necessary schedules and certificates are attached.

- Finalize by filling out Section F: Related Party Transactions, if applicable, and Section G: Summary of Taxes & Contributions Payable & Balances Due.

- Review all entries for accuracy before submitting your form. Save any changes made and proceed to download, print, or share the completed form as necessary.

Ensure your tax documents are filled out accurately and submit them online.

Related links form

Here's how: Place your document into the feeder tray — you can add multiple pages. ... Dial the fax number you want to send your document to. Press Send or Fax — usually a large round button differently colored from the others. ... Wait for a confirmation page to print out. Remove your papers from the outlet tray.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.