Loading

Get Annual Exemption Request Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Annual Exemption Request Form online

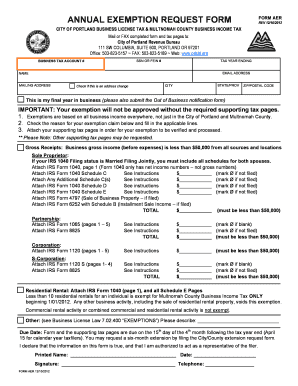

Filling out the Annual Exemption Request Form is an essential step for users seeking exemption from business taxes in the City of Portland and Multnomah County. This guide will walk you through each section of the form, providing clear and detailed instructions for successful submission.

Follow the steps to complete the Annual Exemption Request Form online

- Click 'Get Form' button to obtain the form and open it in the editor.

- Enter your Social Security Number (SSN) or Federal Employer Identification Number (FEIN) in the designated field.

- Provide your Business Tax Account Number, ensuring accuracy to prevent processing delays.

- Input the tax year ending, followed by your email address to facilitate communication regarding your exemption status.

- Fill in your name, mailing address, city, state/province, and zip/postal code accurately.

- If applicable, check the box indicating an address change.

- Indicate if this is your final year in business by checking the appropriate box and remember to submit the Out of Business notification form.

- Review the list of reasons for exemption claims and select the applicable reason, completing any additional lines as instructed.

- Attach the required supporting tax pages in accordance with your business type (sole proprietor, partnership, corporation, etc.) as outlined in the instructions.

- Review the total gross income to ensure it is less than $50,000, marking Ø if not applicable for any lines.

- Fill out the declaration statement confirming that the information provided is true and that you are authorized to submit the request.

- Sign your name, indicate the date, and provide a contact telephone number.

- Once completed, save changes, and choose to download, print, or share the form as necessary.

Complete your Annual Exemption Request Form online today to ensure timely submission.

All individuals are entitled to an annual exempt amount for capital gains tax purposes. Net gains (chargeable gains less allowable losses) for the tax year are free of capital gain tax to the extent that they are covered by the annual exempt amount.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.