Loading

Get Ppo Vs Hmo

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ppo Vs Hmo online

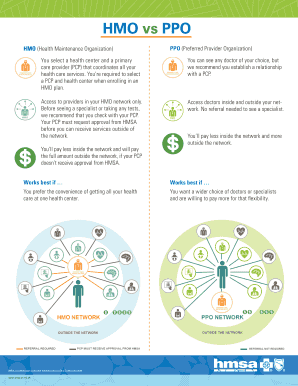

This guide provides a comprehensive overview of how to fill out the Ppo Vs Hmo document online. Whether you are considering a health maintenance organization or a preferred provider organization, understanding this form will help you make informed choices about your healthcare options.

Follow the steps to fill out the Ppo Vs Hmo form online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editing platform.

- Read through the introductory sections about the HMO and PPO plans carefully. This will ensure you understand the differences and can select the plan that best suits your healthcare needs.

- Fill in your personal details in the provided fields. Ensure that all information is accurate to avoid delays in processing.

- If selecting an HMO, choose your primary care provider (PCP) and health center from the provided network options. Make sure to note that referrals are required for specialists.

- If opting for a PPO, you have the flexibility to choose any doctor or specialist without a referral. Indicate your preference in the designated section.

- Review the section about payment structures. Understand the difference in costs associated with in-network and out-of-network providers for both HMO and PPO options.

- After ensuring all information is correct, save your changes. You can then download, print, or share the form as needed.

Complete your documents online today to streamline your healthcare choices.

To summarise, the PPO plan offers too much flexibility and the patient does not need any referral inside or outside the network. One of the biggest benefits of the PPO plan is patients do not need any referral to see any other out of network specialist.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.