Loading

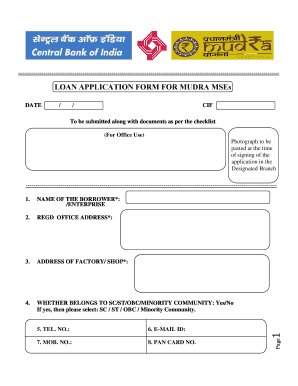

Get Loan Application Form For Mudra Mses

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the loan application form for mudra mses online

Filling out the loan application form for Mudra Micro and Small Enterprises (MSEs) online is a crucial step in securing financial support for your business. This guide provides clear, step-by-step instructions to help you complete the application accurately and efficiently.

Follow the steps to fill out the form successfully.

- Press the ‘Get Form’ button to access the loan application form for Mudra MSEs and open it in your preferred editor.

- Begin by entering the name of the borrower or enterprise in the designated field. Ensure to provide the exact legal name as per registration.

- Fill in the registered office address, making sure to include the complete address including city and state.

- Provide the address of your factory or shop, ensuring accuracy for correspondence purposes.

- Indicate whether you belong to any of the specified communities by selecting 'Yes' or 'No,' and choose from the following options if applicable: SC, ST, OBC, or Minority Community.

- Enter the email ID where you would like to receive communications regarding your application.

- Fill in your mobile number for contact purposes.

- Provide your PAN card number as it is a mandatory field.

- Input your telephone number, which can be your landline or mobile number as required.

- Select the constitution of your business from the options provided, including Individual, Joint, Proprietorship, Partnership, Private Limited Company, Limited Company, Trust, or Others.

- Specify the date of establishment of your enterprise in the format requested.

- Select the state where your business is located from the dropdown menu.

- Indicate the city for which you are applying for the loan.

- Choose the branch where you wish to apply for the loan.

- List the names and addresses of proprietors, partners, or directors of your company. Include their age, academic qualifications, PAN number, and experience in the line of activity.

- Detail your existing banking and credit facilities by completing the required fields regarding outstanding amounts and repayment terms.

- Outline your proposed credit facilities by specifying the type, amount needed, and purpose for which they are requested.

- If applicable, provide details regarding machinery requirements, including the type of machine, its purpose, supplier's name, and total cost.

- Summarize your past performance data and future estimates, particularly emphasizing key financial metrics such as net sales and net profit over the specified years.

- Confirm compliance with statutory obligations by providing the required information regarding various registrations and filings.

- Attach necessary ID proofs and address proofs as per the checklists provided. This may include documents such as passports, utility bills, or bank statements.

- Review the entire form for accuracy. Once satisfied, save your changes, and consider downloading or printing the completed application to retain a record.

Complete your documents online today to facilitate a smooth application process.

Definitions of loan approval. formal authorization to get a loan (usually from a bank) type of: authorisation, authorization, empowerment. the act of conferring legality or sanction or formal warrant.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.