Loading

Get Irs Letter 324c

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Letter 324C online

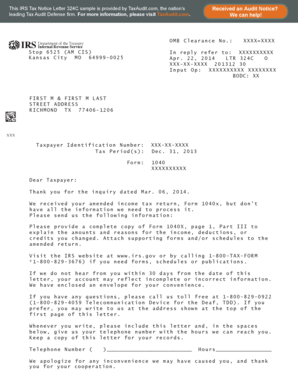

The IRS Letter 324C is a tax notice typically sent to taxpayers requesting additional information regarding an amended income tax return. This guide will walk you through the process of filling out the letter online, ensuring that you provide the necessary details accurately and effectively.

Follow the steps to fill out the IRS Letter 324C online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Review the letter carefully to understand the request. The letter will specify information regarding a previous tax return that requires your attention, typically identified by your taxpayer identification number (TIN) and tax periods.

- Locate the section that lists the information requested by the IRS. This may include a complete copy of Form 1040X, along with any associated forms or schedules that support the changes made to your tax return.

- Prepare and attach the necessary documents as requested in the letter. Ensure these documents clearly explain the amounts and reasons for the changes in your income, deductions, or credits.

- If required, provide your contact information in the designated space at the bottom of the letter. This includes your phone number and available hours for the IRS to reach you regarding the request.

- After filling out the form and attaching all necessary documents, save your changes. You can then download the filled form, print it out for your records, or share it as needed.

Complete your IRS Letter 324C online now to ensure timely processing of your tax matters.

Fax: 855-215-1627 (within the U.S.) Fax: 304-707-9471 (outside the U.S.)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.