Loading

Get Release Of Claim Under Section 1310 - Nycers

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Release Of Claim Under Section 1310 - Nycers online

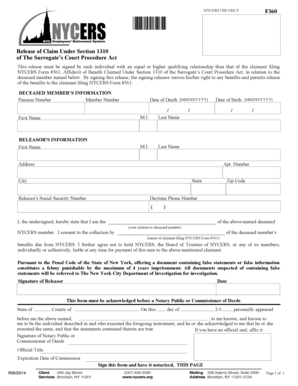

The Release Of Claim Under Section 1310 is an essential document required by the New York City Employees' Retirement System (NYCERS) for individuals who wish to waive their rights to benefits associated with a deceased member. This guide provides detailed instructions on completing this form online, ensuring clarity and simplicity for all users, regardless of their legal experience.

Follow the steps to complete the Release Of Claim Under Section 1310 online.

- Press the ‘Get Form’ button to access the Release Of Claim Under Section 1310 and open it in your chosen editor.

- Begin by entering the deceased member's information. Input the pension number, member number, and the date of death in the specified format (MM/DD/YYYY). Fill in the first name, middle initial, and last name of the deceased.

- Next, provide the releasor's information. Enter their first name, middle initial, last name, and date of birth (MM/DD/YYYY). Include the full address, apartment number (if applicable), city, state, and zip code. Also, add the daytime phone number for contact purposes.

- In the relationship section, specify the releasor's relation to the deceased member by filling in the appropriate title.

- Identify the claimant filing NYCERS Form #361 by writing their name in the provided space.

- The releasor must sign the document and include the date of signing.

- The form requires notarization. Fill out the state and county where the form is notarized, and the date of notarization. The notary public or commissioner of deeds will complete the rest of the acknowledgment, affirming the identity of the releasor.

- After completing the form, review all entries for accuracy. Save the changes, then download, print, or share the completed document as needed.

Complete your documents online to ensure a smooth filing process.

Use Form 1310 to claim a refund on behalf of a deceased taxpayer. If you are claiming a refund on behalf of a deceased taxpayer, you must file Form 1310 if: You are NOT a surviving spouse filing an original or amended joint return with the decedent; and.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.