Loading

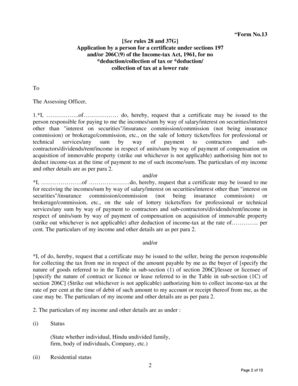

Get 13 See Rules 28 And 37g Application By A Person For A Certificate Under Sections 197 And/or 206c(9)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 13 See Rules 28 And 37G Application By A Person For A Certificate Under Sections 197 And/or 206C(9) online

Filling out the 13 See Rules 28 And 37G Application requires careful attention to detail. This guide provides step-by-step instructions to help you complete the form correctly and efficiently when applying for a certificate under the relevant sections of the Income-tax Act.

Follow the steps to successfully complete your application online.

- Press the ‘Get Form’ button to access the application form and open it in your preferred digital editor.

- Begin by entering your personal information in the first section. Fill in your name and address accurately, and ensure that all details reflect your status as an individual or applicable entity.

- In the next part, specify the type of income for which you are requesting a certificate. You may need to strike out the options that do not apply to you, clearly indicating which type(s) you are applying for.

- Provide your details under paragraph 2. Include your status (individual, firm, etc.), residential status, and your Permanent Account Number (PAN). Make sure to also provide your Tax Deduction and Collection Account Number (TAN) if applicable.

- List details of any returns or statements due but not filed by filling in the relevant sections. Provide reasons for any delays in filing if applicable, along with details of your income for the previous assessment years.

- Complete the sections about tax payments for the past three assessment years. This includes all taxes paid, any credits claimed, and details regarding how you plan to address outstanding liabilities.

- If your income includes business profits, complete the necessary schedules outlining your gross profit and net profit for the last three years.

- Fill out the relevant annexures based on your application need — whether it’s for no deduction of tax or deduction at a lower rate. Ensure all applicable schedules are completed with the requested particulars.

- Review your application thoroughly to check for completeness and accuracy. Make sure that all fields are correctly filled and any striking out is clearly marked.

- Finally, you can save your changes, download a copy of the completed form, print it for your records, or share it as required. Verify all saved details before submission.

Start your application process online today by following these simple steps.

Can I file TDS return after the due date? You can pay TDS after the due date, however penalty of Rs 200 per day as per Section 234E needs to be paid. The deductor is liable to pay the penalty for every day during which the failure continues. However, the amount of late fees cannot exceed the TDS.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.