Loading

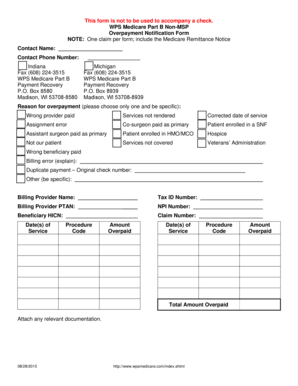

Get Wps Medicare Part B Non-msp Overpayment Notification Form. Wps Medicare Part B Non-msp Overpayment

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WPS Medicare Part B Non-MSP Overpayment Notification Form online

Filling out the WPS Medicare Part B Non-MSP Overpayment Notification Form correctly is essential for efficient processing of overpayment notifications. This guide provides step-by-step instructions to help users navigate the form with ease.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Begin by entering your contact name and contact phone number in the designated fields. This information is vital for communication regarding the overpayment notification.

- Select the reason for overpayment from the provided options. Choose one specific reason that accurately describes the issue. If it falls under billing error, provide a detailed explanation.

- Fill in the billing provider name, tax ID number, billing provider PTAN, and NPI number in their respective fields to ensure proper identification of the provider.

- Enter the beneficiary's Health Insurance Claim Number (HICN) followed by the claim number related to the overpayment. This information is essential for processing.

- Detail the date(s) of service, procedure code, and the amount overpaid for each instance listed. Ensure that this information is accurate as it will be used to verify the overpayment.

- If there are multiple entries, continue adding the relevant details until all overpayments are accounted for.

- Finally, review all the information for accuracy, attach any relevant documentation concerning the overpayment, and save your changes. You can then download, print, or share the completed form as needed.

Complete the WPS Medicare Part B Non-MSP Overpayment Notification Form online for prompt attention to your overpayment issue.

Unsolicited or voluntary refunds are monies not related to an open accounts receivable. Voluntary refunds are not demanded which is when a debt has already been established. To ensure that voluntary refunds are handled properly, we will deposit each check within 24 hours.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.