Loading

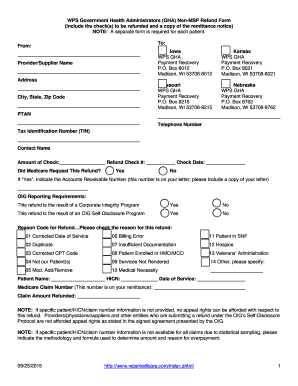

Get Wps Gha Non Msp Refund Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Wps Gha Non Msp Refund Form online

Filling out the Wps Gha Non Msp Refund Form online can streamline the refund process for healthcare providers. This guide offers clear and concise instructions to ensure that users complete the form accurately.

Follow the steps to fill out the form correctly.

- Click ‘Get Form’ button to obtain the Wps Gha Non Msp Refund Form and open it in the editor.

- Fill in the 'To' and 'From' sections at the top of the form. Include the provider/supplier name, and select the appropriate box indicating the state of the claim (Iowa, Kansas, Missouri, or Nebraska).

- Enter the provider's address, including city, state, and zip code. Ensure that this information is accurate for correspondence.

- Complete the sections for PTAN, telephone number, and tax identification number (TIN). This information is crucial for processing your refund.

- Provide the contact name and the amount of the check that you are requesting to refund.

- Indicate whether Medicare requested this refund by selecting 'Yes' or 'No'. If 'Yes', include the Accounts Receivable Number and a copy of the related letter.

- Address the OIG Reporting Requirements. Indicate whether this refund is a result of a Corporate Integrity Program or an OIG Self-Disclosure Program by checking 'Yes' or 'No' for each.

- Select the applicable reason code for the refund from the provided list. This will help delineate the basis for the refund request.

- Fill in the patient name, Health Insurance Claim Number (HICN), date of service, and Medicare claim number. Ensure that this information is precise, as inaccuracies may inhibit appeal rights.

- Specify the claim amount being refunded. If detailed information on the specific patient/HICN/claim number is not available, provide a clear methodology for determining the amount and reason for overpayment.

- Review the completed form for accuracy and completeness. Save your changes as necessary.

- Download, print, or share the completed Wps Gha Non Msp Refund Form as required.

Start completing your Wps Gha Non Msp Refund Form online today to ensure a smooth refund process.

If you fail to pay in full, you get an ITR letter 60–90 days after the initial demand letter. The ITR letter advises you to refund the overpayment or establish an ERS. Otherwise, your debt is referred for collection.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.