Loading

Get City Of Ashland Department Of Finance Occupational License / Net Profit Division P

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CITY OF ASHLAND Department Of Finance Occupational License / Net Profit Division P online

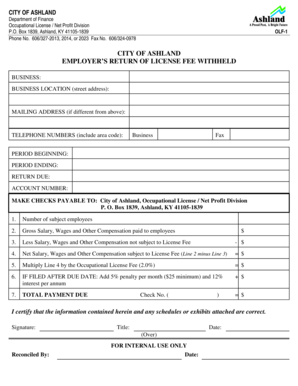

This guide provides clear and comprehensive instructions on how to complete the City of Ashland Department of Finance Occupational License/Net Profit Division P form online. By following these steps, you will ensure accurate submission of your occupational license fee return.

Follow the steps to fill out your Occupational License form online.

- To begin, select the ‘Get Form’ button to access the Occupational License form and open it in your preferred online editor.

- Provide the business name in the designated field. Ensure that the name matches your business registration.

- Enter the business location, including the full street address. This should be where the business operates.

- If your mailing address differs from the business location, fill out the appropriate section with the correct mailing address.

- Include your telephone numbers, ensuring to add the area code for contact purposes.

- Input the period beginning and period ending dates for which you are reporting the occupational license fees.

- Indicate the return due date to ensure timely filing.

- Write down your account number, which should be provided to you by the City of Ashland.

- List the number of subject employees under your business.

- Enter the total gross salary, wages, and other compensation paid to your employees during the reporting period.

- In the next field, deduct any salary, wages, and other compensation not subject to the license fee and enter that amount.

- Calculate the net salary, wages, and other compensation subject to the license fee by subtracting line 3 from line 2.

- Multiply the amount from line 4 by the occupational license fee rate (2.0%) to get the fee owed.

- If you are filing after the due date, include any applicable penalties or interests as specified.

- Total the payment due by summing all amounts calculated above.

- Provide your check number in the designated space if submitting a payment by check.

- Sign the form to certify that the information is correct, and include your title and date.

- Finally, review the form for accuracy, and then save your changes, download or print the completed form for your records.

Complete your Occupational License form online today to ensure compliance with local regulations.

The City of Mayfield Net Profit License Fee is levied at the annual rate of 2% the first $50,000.00, plus 1% of $50,000 thru $500,000 and ½ % over $500,000 with a minimum of $100.00 of the net profits of all occupations, trades, professions or other businesses engaged in said activities in the City.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.