Loading

Get New Account Application - Wells Fargo Funds

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the New Account Application - Wells Fargo Funds online

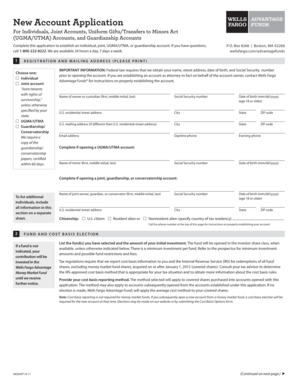

This guide provides clear, step-by-step instructions for completing the New Account Application for Wells Fargo Funds online. Whether you are applying individually or for a joint or guardianship account, this comprehensive resource aims to assist users in accurately filling out the necessary information.

Follow the steps to successfully complete your application.

- Click ‘Get Form’ button to download the New Account Application form and open it in your preferred document editor.

- Select the type of account you wish to establish. Options include Individual, Joint Account, UGMA/UTMA, or Guardianship/Conservatorship. Ensure that you meet the requirements for your chosen account type.

- Fill in the registration and mailing address section. Provide your name, Social Security number, date of birth, and residential address, as required by federal law.

- If opening a UGMA/UTMA account, include the name of the minor. For joint, guardianship, or conservatorship accounts, complete the additional required fields for joint owners or guardians.

- In the Fund and Cost Basis Selection section, list the selected fund(s) and the amounts you intend to contribute. Review the prospectus for minimum investment requirements.

- Choose your preferred cost basis reporting method for non-money market funds and specify the method for each fund if applicable.

- Indicate your investment method by selecting check, exchange, or wire. Ensure to provide all necessary information for your selected method.

- Complete the check writing option section if you wish to add checkwriting privileges to your money market and/or bond fund(s). All account owners must sign if applicable.

- In the Establish Account Options section, select any automatic investment plan (AIP) or direct deposit options you want, and include any required voided checks.

- Provide the bank information section to establish electronic funds transfer capabilities, confirming that the account name matches your Wells Fargo account.

- Consent to receive documents electronically by signing the appropriate section if you prefer your account statements and reports in digital format.

- Complete the signature section, ensuring all relevant parties sign and date the application. Verify that all sections are completed before submission.

- Once all sections are filled and signed, you can save the changes, download the form, print it, or share it as needed for final submission.

Begin your online application now to establish your Wells Fargo Funds account seamlessly.

Do I need to make a minimum deposit in my account? Yes, many banks require a minimum deposit to open an account. Wells Fargo requires a minimum deposit of $25 to open an account. Be sure to bring cash or a check with you so you'll be able to deposit money into your new account.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.