Get Mod. 21-rfi

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the MOD. 21-RFI online

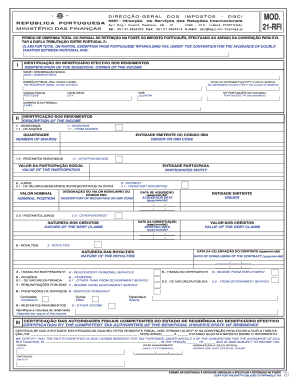

The MOD. 21-RFI form is essential for claiming total or partial exemption from Portuguese withholding tax. This guide provides clear and comprehensive steps to help you successfully complete this form online, ensuring all necessary information is accurately captured.

Follow the steps to fill out the MOD. 21-RFI online:

- Press ‘Get Form’ button to access the MOD. 21-RFI form and open it in your preferred editor.

- In Box I, provide details for the beneficial owner of the income. Include the full name or business name, Tax Identification Number (TIN) in the residence country, postal address, city, postcode, country, and Portuguese TIN if available. Ensure that the information is typed in uppercase letters.

- In Box II, identify the income. Indicate the type of income derived in Portugal, marking specifics such as dividends, interests, or royalties. If applicable, include the ISIN code for securities in the designated field.

- In Box III, leave this area blank as it is reserved for certification by the competent tax authorities of the state of residence.

- In Box IV, respond to the questions with a 'Yes' or 'No' and provide details where necessary.

- Complete Box V only if applicable, providing information about the financial intermediary non-resident in Portugal, if you hold shares or securities through them.

- In Box VI, fill in the identification details of the entity in Portugal that is obliged to withhold tax.

- In Box VII, if you have a legal representative, provide their name and relevant identification details.

- In Box VIII, submit a statement certifying that the provided information is accurate and sign the declaration, ensuring it is dated.

- Once all sections are thoroughly completed, review the form for accuracy. You can then save, download, print, or share the completed MOD. 21-RFI form.

Complete your MOD. 21-RFI form online today!

Related links form

The MOD. 21-RFI form is a critical document required for tax declaration in Portugal, especially for non-residents and those benefiting under special tax regimes. This form helps manage your tax obligations effectively and ensures compliance with local regulations. By utilizing uslegalforms, you can easily access and complete the MOD. 21-RFI, making your tax filing process smoother. Understanding this form is essential for anyone navigating the Portuguese tax landscape.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.