Get Nj Cri-200 2008-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ CRI-200 online

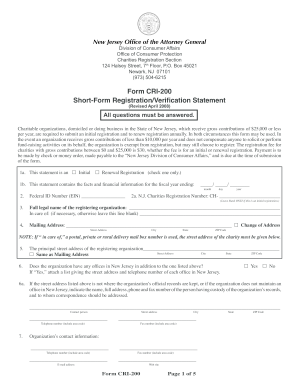

The NJ CRI-200 form, also known as the Short-Form Registration/Verification Statement, is essential for charitable organizations in New Jersey that receive gross contributions of $25,000 or less per year. This guide will provide you with clear and concise instructions on how to complete this form online, ensuring that you meet all filing requirements effectively.

Follow the steps to complete the NJ CRI-200 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Select whether this statement is an initial or renewal registration by checking the appropriate box in section 1a.

- In section 1b, indicate the fiscal year ending date by filling in the month, day, and year.

- Provide your federal ID number (EIN) in section 2 and, if applicable, your New Jersey Charities Registration Number in section 2a.

- In section 3, write the full legal name of your organization. If necessary, complete the ‘In care of’ line.

- Fill in the mailing address in section 4 and indicate if there is a change of address.

- Complete section 5 for the principal street address of the registering organization and indicate whether it is the same as the mailing address.

- If applicable, provide details about any additional New Jersey offices in section 5, and note if additional information is attached.

- In sections 8 and 9, confirm the organization’s eligibility and report any changes in organization details since the last submission.

- Sections 10 to 15 require explanations about the organization’s purpose, solicitation practices, and any legal concerns.

- In section 16, provide information about officers and high-compensated employees, attaching necessary documents.

- Ensure that two authorized officers, including the chief financial officer, sign the form in the designated signature section.

- Review the financial statement section and ensure all revenue and expense figures are accurately reported.

- After completing the form, you can save your changes, download, print, or share the final document.

Begin your online filing process now to ensure compliance with the New Jersey Charities Registration requirements.

Individuals and entities with income subject to New Jersey tax obligations need to file NJ CRI. This includes residents, non-residents earning income in New Jersey, and certain partnerships and corporations. If you receive taxable income, it is important to file to comply with state regulations. For help with your NJ CRI filings, consider using US Legal Forms for guidance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.